Economic Intelligence Briefing: December 2022

23 December 2022

A statistical report compiled by Skills For Growth (SfG) that outlines UK-wide and Greater Manchester specific economic trends and forecasts. The main data was collected in the 18 weeks up to the publication data of 16 December 2022.

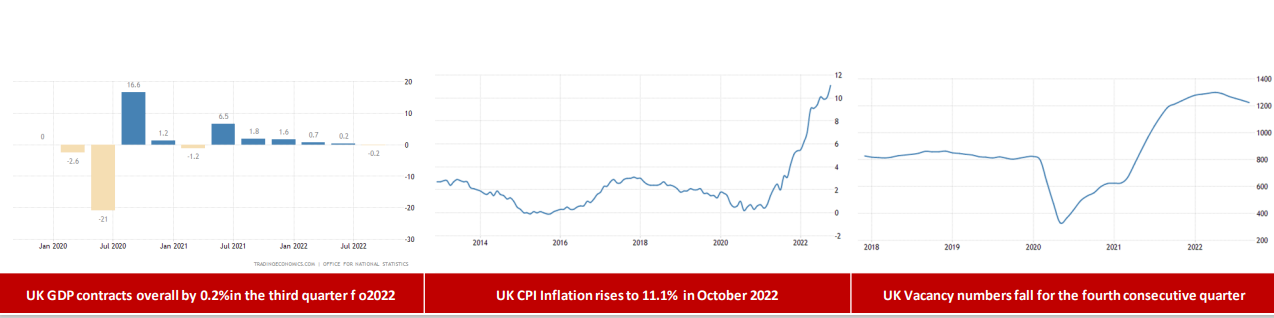

The British economy shrank 0.2% on quarter in Q3 2022, the first contraction in 1-1/2-years but lower than market forecasts of a 0.5% drop, preliminary estimates showed.

The services sector stalled, driven by a fall in consumer-facing services while the production sector went down 1.5%, including a 2.3% fall in manufacturing and a 1% loss in mining and quarrying. In expenditure terms, household spending went down 0.5%, business investment shrank 0.5% while exports jumped 8% and imports fell 3.2%. The number of job vacancies in August to October 2022 was 1,225,000, which is a decrease of 46,000 from May to July 2022. Quarterly growth fell for the fourth consecutive period to negative 3.6% in August to October 2022.

UK Economic Projections

The Bank of England and Monetary Policy Committee’s figures present a challenging future outlook for the economy.

- GDP is projected to fall throughout 2023 (declining 0.75% in H2) into H1-2024, as high energy prices and materially tighter financial conditions weigh on spending.

- UK is expected to be in recession for a prolonged period and CPI inflation will remain elevated at over 10% in the near term, then falling from mid-2023 onwards.

UK Labour Market Context

- The UK employment rate for August to October 2022 increased by 0.2 percentage points on the quarter to 75.6% but is still below pre-coronavirus (COVID-19) pandemic levels. Over the latest three-month period, the number of employees increased, while self-employed workers decreased.

- Estimates of pay-rolled employees for November 2022 shows another monthly increase, up 107,000 on the revised October 2022 figures, to a record 29.9 million.

- The unemployment rate for August to October 2022 increased by 0.1 percentage points on the quarter to 3.7%. In the latest three-month period, the number of people unemployed for up to six months increased, and this increase was seen across all age groups.

- The economic inactivity rate decreased by 0.2 percentage points on the quarter to 21.5% (August to October 2022). The decrease in economic inactivity during the latest three-month period was driven by those aged 50 to 64 years. Looking at economic inactivity by reason, the quarterly decrease was driven by those inactive because they are retired.

- In September to November 2022, the estimated number of vacancies fell by 65,000 on the quarter to 1,187,000. Despite five consecutive quarterly falls, the number of vacancies remains at historically high levels. The fall in the number of vacancies reflects uncertainty across industries, as respondents cite economic pressures holding back on recruitment.

- In real terms (adjusted for inflation) over the year, total and regular pay both fell by 2.7%; this is slightly smaller than the record fall in real regular pay we saw in April to June 2022 (3.0%) but remains among the largest falls in growth since comparable records began in 2001.

Local Business Context – GC Survey

- The latest results show that confidence continues to be strong in the face of difficult economic circumstances.

- Confidence remains higher than other OECD countries possibly linked to resilience through the last 2 difficult years.

- The main risks are high costs, decreased sales, and supply chain issues.

- Cost risks have reduced slightly in the latest survey, but a major problem for a third of firms.

- Two-thirds of firms are certain they have reserves to last over 6 months. This has edged lower over the last quarter.

- Cashflow problems are affecting a fifth of businesses as a serious risk.

- This month shows a significant 10 percentage point fall in the proportion of firms expecting to increase Capex next year.

- Despite risks to investment, the main business support needs are the same as last month:

- Business planning, sales & marketing, workforce development, innovation support, and financial advice.

- There has been an increase in proportion of firms recruiting – typical of the run-up to December (27% vs 23% in October).

- Half of survey respondents reported workforce skill gaps, main areas: sales, marketing and leadership, and digital.

- SfG insight shows main barriers are cost (higher level IT courses!), lack of time to develop staff, quality of courses vary.

- Response rate: 255 surveys between the 4th November 2022 to 2nd December 2022.

Local Skills Intelligence – Headlines

- Main sectors showing high demand for new hires in last 12 weeks, health & social care, manufacturing, DCT roles. Occupations which are in high demand were e-sales & marketing, digital roles from back-office support to technical.

- Hard-to-fill vacancies. 24% of SfG SME support clients report H2F vacancies. This is similar to the GC business survey.

- H2F across a range of sectors, in particular: care, construction, hospitality, manufacturing, and digital technology sectors.

- Skill gaps. 64% of SfG clients report skill gaps in their current workforce, causing them to lose business to competitors.

- Employee skill gaps. Most skill gaps relate to M&L, advanced technical/digital skills (L3/L4+), sales & marketing skills.

- The main causes and impacts of training difficulties- time, cost, uncertainty. Main impacts are lost trade / staff pressure.

- Skills Map - most popular courses in period: M&L, digital (e.g. Microsoft office), marketing& sales, business development.

- Main future areas for training identified by firms. M&L, digital sales & marketing, and HR /staff development.

- Sectors most likely to identify digital skills are logistics, retail/wholesale, manufacturing and engineering, and digital tech.

- Tech roles across various manufacturing sectors e.g. demand for digital training in advanced manufacturing and textiles.

- Types and levels of digital skills requirements (examples, reporting by exception)

- Basic skills. Emails and communication skills, MS Office = Excel, database use

- Higher level skills and experience: Analytics (data engineering and analysts, SQL/PBI/Azure), sales & marketing (social media, design/advertising), developers (coding web and software), and IT business analysts (project management).

The GC Business Growth Hub's #HereForBusiness support package provides practical help, guidance, and expert advice on a range of subjects to help companies in Greater Manchester manage the increasing cost of doing business.

For further information, and to access tailored support, contact us now.