Supporting self-isolation due to coronavirus – a guide for business

17 March 2021

Our guide will take you through the key steps employers should take to enable staff to self-isolate when required to do so, to stop the spread of coronavirus and help restart the economy.

Self-Isolation guidance - February 2022 Update

Guidance for individuals testing positive

- From 24 February 2022, individuals are no longer legally required to self-isolate if they test positive for COVID-19.

Guidance for contacts

From 24 February 2022:

- Fully vaccinated adults and those aged under 18 who are close contacts are no longer advised to test daily for seven days

- Unvaccinated close contacts are no longer legally required to self-isolate

Since the beginning of the pandemic, testing for COVID-19 has been highlighted as one of the main pillars of the government’s reopening strategy. In addition to identifying and isolating symptomatic individuals, testing can also help capture positive cases in asymptomatic individuals. With approximately 1 in 3 individuals with COVID-19 not showing symptoms, and potentially infecting people unknowingly, regular testing is needed to break the chains of transmission. More information on testing is available through our dedicated guide.

Government guidance on self-isolation

To help protect employees from infection and keep businesses open, employers should continue playing their part and encourage their workers to get tested and self-isolate in the event of a positive result.

To help reduce the risk of transmission, individuals are legally required to self-isolate if they test positive for coronavirus. If a staff member has been notified by the NHS COVID-19 app to self-isolate and they apply for the Test and Trace Support Payment, they will also be legally required to self-isolate even if they are not deemed eligible for the payment.

Actioning a positive lateral flow test

From 11 January in England, people who receive positive lateral flow device (LFD) test results for coronavirus (COVID-19) will be required to self-isolate immediately and won’t be required to take a confirmatory PCR test (*Exceptions apply).

Under this new approach, staff members who receive a positive LFD test result should report their result on GOV.UK and must self-isolate immediately but will not need to take a follow-up PCR test. After reporting a positive LFD test result, they will be contacted by NHS Test and Trace so that their contacts can be traced and must continue to self-isolate.

*Exceptions

The following groups will be asked to take a confirmatory PCR if they receive a positive LFD result:

- Individuals applying for the £500 Test and Trace Support Payment (TTSP)

- Travellers having received a positive Day 2 lateral flow result after arriving in the UK

- Individuals participating in research or surveillance programmes according to the research or surveillance protocol

- Individuals who are at particular risk of becoming seriously ill from COVID-19 and have been identified by the NHS as being potentially eligible for new treatments. They will be receiving a PCR test kit at home by mid-January to use if they develop symptoms or if they get a positive LFD result, as they may be eligible for new treatments if they receive a positive PCR result.

Self-isolation guidance for individuals with a positive COVID-19 test

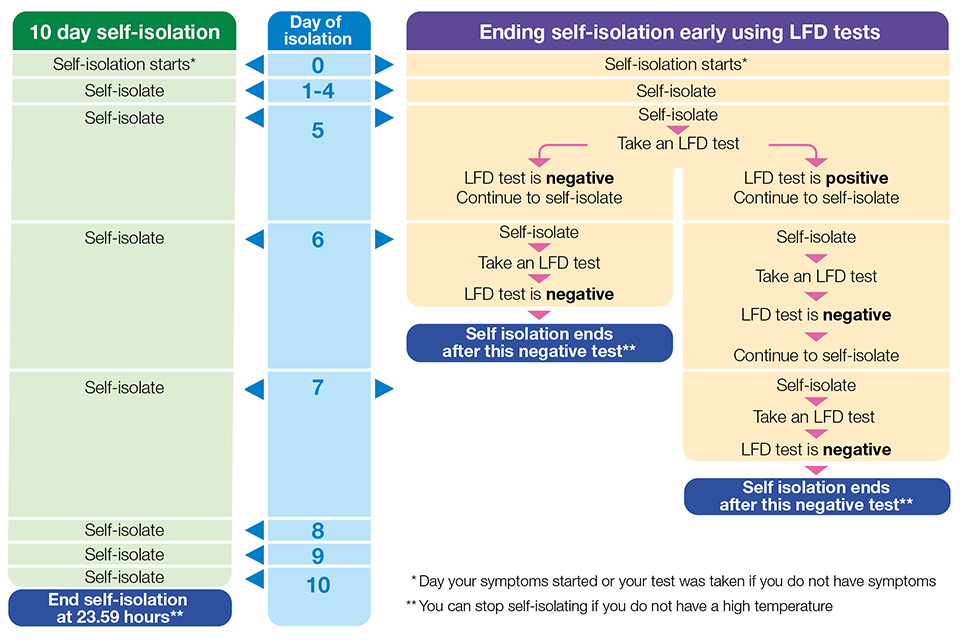

Individuals who test positive must self-isolate from the day their symptoms started and the next 10 full days, or from the day their test was taken if they do not have symptoms and the next 10 full days.

People testing positive may be able to end their

self-isolation period before the end of the 10 full days. This means that they may be able to leave isolation at the start

of day six* provided they test negative on both day 5 and day 6 and do not have a temperature.

Individuals should report their LFD test results after taking each test.

The first test must not be taken before the fifth day after their symptoms started (or the day their test was taken if they did not have symptoms)

Individuals who are still positive on their lateral flow tests must stay in isolation until they have had two consecutive negative tests taken on separate days.

Please note: Self-isolation may continue in certain circumstances, such as for those who work with vulnerable people. A full list will be published in guidance in due course.

*This does not impact the guidance for unvaccinated contacts of positive COVID-19 cases, who are still required to self-isolate for 10 full days after their date of exposure to the virus.

Examples of when to end self-isolation if you have had COVID-19 symptoms or have received a positive COVID-19 test result

Examples of when to end self-isolation if you have had COVID-19 symptoms or have received a positive COVID-19 test result

Self-isolation guidance for close contacts of a positive case

With regards to close contacts, the rules on self-isolation have changed. This means that employees who fall under the following categories are no longer required to self-isolate if they are a contact of a positive case. Instead, they are advised to take daily lateral flow tests for 7 days or until 10 days since their last contact with the person who tested positive for COVID-19 if this is earlier. If any of these test results are positive, they should self-isolate immediately.

Contacts who are not required to self-isolate

- Fully vaccinated staff

- Staff who have taken part in – or are currently taking part in – an approved COVID-19 vaccine trial

- Staff who can evidence that they cannot be vaccinated for medical reasons

- Staff below the age of 18 years 6 months

Contacts who are required to self-isolate

- Staff members are legally required to self-isolate for 10 days if they are aged over 18 years and 6 months, not fully vaccinated and either live in the same household as someone with COVID-19 or are a contact of someone who has had a positive test result for COVID-19.

Employees do not need to inform you if they are a close contact of someone who tested positive but are exempt from self-isolation (there is separate guidance for health and social care staff) and you are not expected to check whether a staff member is exempt from self-isolation.

Please note, employers must not knowingly allow staff who have tested positive for COVID-19 or have been identified as close contacts of a positive case and don’t belong to the groups listed above to come into work. Failure to do so could result in your business facing a fine.

However, workplaces in sectors that provide essential services, including food distribution and production, emergency services, transport networks, defence, prisons, waste collection and energy, will continue to be able to use the Workplace Daily Contact Testing scheme to offer daily testing as an alternative to self-isolation for close contacts who are not fully vaccinated enabling them to continue attending work provided they test negative each day.

Businesses should take into account that self-isolation may be challenging for certain employees as they might face financial hardship and other challenges due to their inability to attend work. To enable staff to follow the self-isolation rules, employers should consider the following actions.

For the most up-to-date national guidance visit the government website.

Financial support

Statutory Sick Pay (SSP)

Statutory Sick Pay (SSP) is available for eligible individuals self-isolating because they (or their household) are exhibiting symptoms or have been diagnosed with COVID-19. SSP can also be claimed if an employee is self-isolating because they've been notified by the NHS or public health bodies that they have come into contact with someone with coronavirus and are not exempt.

SMEs may be eligible to claim back Statutory Sick Pay paid to employees due to coronavirus (COVID-19) via the Coronavirus Statutory Sick Pay Rebate Scheme.

Eligible employers are able to make claims retrospectively for COVID-related sickness absences having occurred from 21 December 2021 onwards.

Please note the scheme ends on 17 March 2022. Employers have up to and including 24 March 2022 to:

- submit any final claims

- amend claims they’ve already submitted

If you require evidence, an isolation note can be obtained from NHS 111 online (if the employee is self-isolating and cannot work because of COVID-19). You can check if an isolation note is valid by using the Check an isolation note service.

Self-employed individuals who are not eligible for sick pay can apply for Universal Credit and/or apply for New Style Employment and Support Allowance.

Benefits

- New Style Employment and Support Allowance (ESA) – Individuals cannot claim New Style ESA if they are

getting Statutory Sick Pay (SSP). - Universal Credit – Individuals might be able to claim Universal Credit at the same time as SSP or New Style ESA.

- Pension Credit – Eligible applicants might be able to get Pension Credit at the same time as SSP.

COVID-19 specific schemes

Test and Trace Support Payment Scheme

Update: The scheme closed on 24 February 2022. Individuals who were instructed to self-isolate before this date will still be able to claim support payments within the next 42 days.

Individuals who are required to self-isolate because of coronavirus but who cannot work from home and therefore, might lose income may be entitled to a £500 Test and Trace Support Payment.

In order to be eligible for the scheme, individuals must have been instructed by NHS Test and Trace or the NHS COVID-19 app to self-isolate, either because they’ve tested positive for COVID-19 or have recently been in close contact with someone who has tested positive and are not exempt from self-isolation. The scheme is open to both employed and self-employed applicants.

On 22 February 2021, the government expanded the scheme to also support parents and guardians who are unable to work because they are caring for a child who is self-isolating.

Whilst individuals who are currently receiving or are the partner of someone in the same household who is receiving at least one of the qualifying benefits may be eligible for the main scheme, individuals not in receipt of benefits, may also be eligible for a discretionary £500 payment.

To view the full eligibility criteria for the scheme, visit the government’s website.

The support payment will be provided in addition to any benefits and Statutory Sick Pay eligible individuals currently receive.

Individuals will be able to apply for the Test and Trace Support Payment scheme and the discretionary payment through their Local Authority. For more information on how to apply for the scheme, visit the government’s website.

Individuals based in Greater Manchester can find further details about the Test and Trace Support Payment Scheme through their local council’s website.

Bolton

Bury

Manchester

Oldham

Rochdale

Salford

Stockport

Tameside

Trafford

Wigan

Practical and emotional support

GM Community Hubs

GM Community Hubs

Support for individuals who might need assistance with sourcing food or medical supplies.

Read more Mental Health Resources Pack

Mental Health Resources Pack

Resources and services to support your employees' mental health and wellbeing.

Read more Citizens Advice

Citizens Advice

Support for individuals unable to pay their bills because of coronavirus.

Read more Coronavirus and isolation

Coronavirus and isolation

Access Mental Health at Work's toolkit to help support yourself and your colleagues during self-isolation.

Read moreAdditional Resources

Coronavirus testing

Coronavirus testing

Read our guide for more information on community and workplace testing for people without coronavirus symptoms.

Read more Managing COVID-19 cases in the workplace

Managing COVID-19 cases in the workplace

Guidance for employers, businesses and workers to manage the risk of transmission in the workplace whilst supporting the NHS test and trace service.

Read more COVID-19 vaccines

COVID-19 vaccines

Our guide will help businesses ensure their staff can find accurate and timely information on COVID-19 vaccines.

Read more Domestic abuse: getting help

Domestic abuse: getting help

Advice to self-isolate due to coronavirus does not apply if an individual needs to escape from domestic abuse.

Read moreMore information is available on the UK Government’s Coronavirus Business Support website. For more personalised advice call us on: 0161 359 3050 or email us at: BGH@growthco.uk

The information provided is meant as a general guide only rather than advice or assurance. GC Business Growth Hub does not guarantee the accuracy or completeness of this information and professional guidance should be sought on all aspects of business planning and responses to the coronavirus. Use of this guide and toolkit are entirely at the risk of the user. Any hyperlinks from this document are to external resources not connected to the GC Business Growth Hub and The Growth Company is not responsible for the content within any hyperlinked site.