Coronavirus Job Retention Scheme

22 March 2020

Find out the latest information about the Coronavirus Job Retention Scheme for UK employers.

This page was updated on 1 October 2021.

*The Job Retention Scheme has now closed *

If your business requires support, our team of experts can help you address financial difficulties and help you review, reorganise and reshape your business model, workforce and operating systems. Tell us about your business and we’ll find the right advisor and service for your needs.

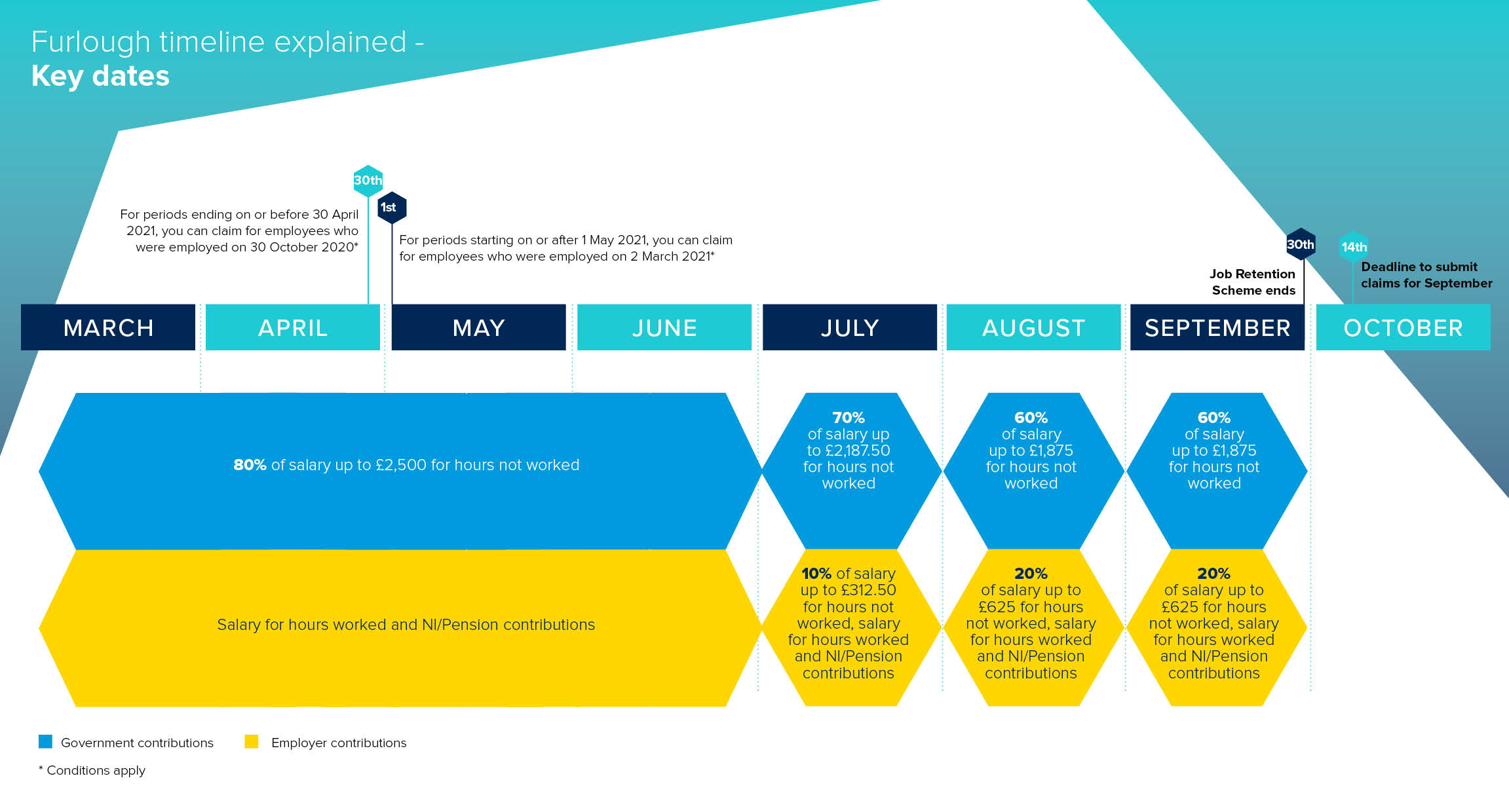

Furlough timeline

Job Retention Scheme: July 2021 - September 2021

From 1 July 2021, the level of grant will be reduced each month and employers will be asked to contribute towards the cost of furloughed employees’ salaries for hours not worked.

| For hours not worked | July | August | September |

| Government contributions | 70% of salary up to £2,187.50 | 60% of salary up to £1,875 | 60% of salary up to £1,875 |

| Employer contributions | 10% of salary up to £312.50 | 20% of salary up to £625 | 20% of salary up to £625 |

| National Insurance and employer pension contributions | National Insurance and employer pension contributions | National Insurance and employer pension contributions |

Key information

- Grant payments are expected 6 working days after the first claims

- Businesses have the flexibility to bring furloughed employees back to work on a part-time basis (for any amount of time and shift pattern) or furlough them full-time

- Employees must not work or provide any services for their employer during time which they are recorded as being on furlough (this applies even if they receive a top-up wage)

- For claim periods starting on or after 1 December 2020, employers cannot claim for any days on or after 1 December 2020 during which furloughed employees were serving a contractual or statutory notice period (this includes people serving notice of retirement or resignation).

- Furloughed employees who are made redundant, will be required to receive statutory redundancy pay based on their normal wages, rather than a reduced furlough rate.

Eligibility

- All employers with a UK, Isle of Man or Channel Island bank account and a UK PAYE scheme can claim the grant.

- Employers can claim whether their businesses are open or closed.

- Employees can be on any type of contract.

- For periods starting on or after 1 May 2021, employees must have been on an employer’s PAYE payroll on 2 March 2021. This means a Real Time Information (RTI) submission notifying payment for that employee to HMRC must have been made between 20 March 2020 and 2 March 2021.

For further information on eligibility and to check which employees you can furlough visit the government website.

Before you make a claim you should calculate how much you can claim.

How to claim - Claims for September must be submitted by 14 October and any amendments must be made by 28 October 2021.

Key information

- The claim period must start and end within the same calendar month.

- When claiming the grant for furloughed hours, employers will need to report and claim for a minimum period of 7 consecutive calendar days. You can only claim for a period of fewer than 7 days if the period you are claiming for includes either the first or last day of the calendar month, and you have already claimed for the period ending immediately before it.

- Claims relating to each subsequent month should be submitted by 11.59 pm 14 calendar days after the month you’re claiming for (If this falls on the weekend then claims should be submitted on the next working day.) To check the monthly deadlines for claims, refer to the government's website.

In order to make a claim you will need:

- to be registered for PAYE online

- your employer PAYE scheme reference number

- the billing address on your bank account

- your bank account number and sort code (only provide bank account details where a BACS payment can be accepted)

- the number of employees being furloughed. You can download a template if you’re claiming for 16 or more employees (HMRC will accept the following file types: .xlsx, .csv)

- each employee's National Insurance number

- the start date and end date of the claim

- the full amounts of employee wages you’re claiming for

- your contact name

- your phone number

The full details on what you will need to make a claim including additional information required for employees that are flexibly furloughed has been published on the government website, here.

A step by step guide to help employers make a claim through the Job Retention Scheme has also been published.

Businesses can claim for their employees’ wages through the online service available on the government website. Employers have the opportunity to also delete a claim, as long as it is within 72 hours of submitting it.

After you have claimed

You must:

- keep a copy of all records for 6 years

- inform your employees that you have made a claim and no further action is needed

- pay your employee their wages, if you have not already

- check if you need to report payments on the PAYE Real Time Information system

- If you made an error and have not claimed enough, you should contact HMRC to amend the claim. For claims relating to periods after 1 November 2020, you will only be able to increase the amount of your claim if you amend the claim within 28 calendar days after the month the claim relates to (unless this falls on a weekend and then it is the next working day).

- If you have made an error and overclaimed, you should:

- correct it in your next claim (your new claim will be reduced and you’ll need to keep a record of the adjustment for 6 years)

- get a payment reference number and pay HMRC back within 30 days (this only applies if you’re not making another claim)

A YouTube video providing an overview of the Job Retention Scheme can be accessed through the government's website. For further information, register for HMRC's explainer webinar.

What if I am self-employed?

The Self-Employment Income Support Scheme has been extended. You can find out more about the fifth and final grant here. GOV.UK has further details about who is eligible for the scheme and how it will work.

Job Retention Scheme: November 2020 - June 2021

Key information

- For hours not worked:

- employees will receive 80% of their current salary up to a maximum of £2,500

- employers will only be required to cover National Insurance and employer pension contributions. Employers are still able to choose to top up employee wages above the scheme grant at their own expense if they wish.

- For hours worked:

- employees will be paid by their employer in the normal way subject to their employment contract

- employers will be responsible for covering National Insurance and employer pension contributions.

Eligibility

- All employers with a UK, Isle of Man or Channel Island bank account and a UK PAYE scheme can claim the grant.

- Employers do not need to have previously claimed for an employee before 30 October 2020 to claim.

- Employers can claim whether their businesses are open or closed.

- Employees can be on any type of contract.

- For periods ending on or before 30 April 2021, employees must have been on an employer’s PAYE payroll on 30 October 2020. This means a Real Time Information (RTI) submission notifying payment for that employee to HMRC must have been made between 20 March 2020 and 30 October 2020

- For periods starting on or after 1 May 2021, employees must have been on an employer’s PAYE payroll on 2 March 2021. This means a Real Time Information (RTI) submission notifying payment for that employee to HMRC must have been made between 20 March 2020 and 2 March 2021.

For further information on eligibility and to check which employees you can furlough visit the government website.

Steps to take before you claim

Before you make a claim you should:

- decide the length of your claim period

- work out what to include when calculating wages

- work out your flexibly furloughed employee’s usual hours and furloughed hours

- calculate how much you can claim

Making your claim - Claims for June must be submitted by 14 July.

Information on how to make a claim including additional information required for employees that are flexibly furloughed has been published on the government website, here.

A step by step guide to help employers make a claim through the Job Retention Scheme has also been published.

Businesses can claim for their employees’ wages through the online service available on the government website.

Job Retention Scheme: March 2020 - October 2020

Key information

- The Coronavirus Job Retention Scheme is a grant and therefore businesses will not have to pay this back

- Businesses will designate affected employees as 'furloughed workers' and notify employees of this change

- From March to end of August, HMRC will reimburse 80% of furloughed workers wages up to £2500 per person, per month

What does furloughing mean?

To be eligible for the scheme the employee must be furloughed. Furlough leave has been introduced by the government during the Coronavirus pandemic to mean leave offered which keeps employees on the payroll without them working. As the furloughed staff are kept on the payroll, this is different to being laid off without pay or being made redundant.

From the period between March to end of June, any furloughed staff are NOT allowed to do any work for the employer during the period in which they are furloughed. The grants do not cover wages of employees working a reduced schedule due to the virus; the employee mustn’t work for the employer at all during the furloughed period - this is different to short term working and layoff.

On 24th April, the government announced that furloughed employees planning to take paid parental or adoption leave would be entitled to pay based on their usual earnings rather than a furloughed pay rate. More information on the announcement can be seen here.

Furloughed employees are also entitled to annual leave and should be paid their usual holiday pay. In this case, employers can still claim 80% of the workers’ salaries, but will have to make up the difference where the normal holiday pay rate is higher. During the furlough period, employees can also continue to accrue holiday as outlined in their employment contract. If a staff member is flexibly furloughed then any hours taken as holiday during the claim period should be counted as furloughed hours rather than working hours. Employers should not put staff on furlough for a period just because they are on holiday for that period. More details relating to holiday pay can be seen here.

Who can apply for the scheme?

First phase of the Scheme: March – May

Any employer can apply for the scheme. The scheme is aimed at avoiding redundancies for the temporary period where an employer is unable to cover costs due to COVID-19. Self-employment is not covered by the scheme.

Key Points to note:

-

An employee must not work for the employer during the time of being furloughed to be eligible for the scheme. This applies for the months March to end of June.

-

An employee must agree to be furloughed and therefore a business must have this conversation with the employees. Changing the status of an employee is always subject to existing employment law.

- Employees can be on any type of contract, including: full-time, part-time, agency contracts, flexible or zero-hour contracts. The scheme also covers employees who were made redundant if they were rehired by their employer on or before 19 March 2020 (original cut-off date was 28 February 2020 which was extended by the Chancellor on the 15th April).

- Employees must be employed under PAYE to be eligible for the scheme and must have been on PAYE payroll on 19 March 2020.

- Employees can undertake training or volunteer subject to public health guidance, as long as employees are not:

- making money for an employer or a company linked or associated to an employer

- providing services to an employer or a company linked or associated to an employee

- Any employees placed on furlough must be furloughed for a minimum period of 3 consecutive weeks. When they return to work, they must be taken off furlough.

- Employees can be furloughed multiple times, but each separate instance must be for a minimum period of 3 consecutive weeks.

-

An employer is not required to pay the additional 20% - however they can top up pay if they chose to do so.

-

Employment law will still prevail within this situation and therefore an employer needs to ensure they are still treating staff fairly and reasonably and not discriminate in line with employment law.

- From March to end of July, Government will also cover employer National Insurance and pension contributions of furloughed workers – on top of 80% of salary

Second Phase of the Scheme – June to October

The eligibility criteria from the first phase (March – May) of the Job Retention Scheme remains the same for the second phase (June – October), however there are changes to the scheme as of June.

- During the month of June, essentially nothing changes in terms of payments and flexibility. However, the scheme will close to new entrants from 30 June. From this point onwards, employers will only be able to furlough employees that they have furloughed for a full 3-week period prior to 30 June. This means that the final date by which an employer can furlough an employee for the first time will be June 10. However, on the 9th June the government announced that this cut-off date will not apply to parents returning to work from paternity and maternity leave in the coming months who will still be eligible for the scheme. This will also apply to military reservists. You can furlough an employee who is a military reservist returning to work after a period of mobilisation after 10 June, even if you are furloughing them for the first time. It is important to note that in both cases this will only apply where they work for an employer who has previously furloughed employees. Full details on eligibility can be seen here.

- From 1 July 2020, businesses will be given the flexibility to bring furloughed employees back part time. Under the flexible scheme, the minimum period is one week. To be eligible for the grant, businesses must confirm in writing to their employees that they have been furloughed. Employers must:

- ensure the agreement is consistent with employment, equality and discrimination laws

- maintain a written record of the agreement for 5 years

- maintain records of how many hours employees work and the number of hours they are furloughed

- A YouTube video providing an overview of the Job Retention Scheme, including details on flexible furloughing can be accessed here.

- 1 July is the earliest date you will be able to make claims for days in July.

- Individuals who are paid through PAYE but not necessarily employees in employment law (e.g. office holders including company directors), can continue to be furloughed from 1 July as long as they have previously been furloughed for a period of at least 3 weeks between 1 March and 30 June 2020. More information is available through the government website.

- Employers can continue to claim the grant for furloughed employees who are serving a statutory or contractual notice period. However, grants cannot be used to substitute redundancy payments.

- The maximum number of employees businesses can claim for in any single claim period starting from 1 July cannot exceed the maximum number of employees they claimed for under any claim ending by 30 June.

- 31 July is the last day that you can submit claims for periods before or on 30 June.

- In August the UK Government contribution will stay at 80%. However, employers will be asked to pay National Insurance and employer Pension contributions. From August onwards employers must pay National Insurance and Pension contributions.

- In September, employers will be asked to start paying towards people’s wages. The UK Government will pay 70% of the furlough grant, employers 10%.

- In October, UK Government will pay 60%, employers 20%. The scheme will end in October.

- November 30 is the last day employers can submit or change claims for periods ending on or before 30 October 2020.

- Furloughed employees or staff who have had their working hours reduced below the current statutory working time requirement for Enterprise Management Incentives (EMI) as a result of COVID-19 will retain the tax advantages of the scheme. More information on the changes to the working time requirements for Enterprise Management Incentives during coronavirus is available on the government website.

- On 30 July the government announced the introduction of a new law which will ensure that furloughed employees receive statutory redundancy pay based on their normal wages, rather than a reduced furlough rate.

- While the scheme will end in October, there is a one-off Job Retention Bonus which will be paid from February 2021. The Bonus is a onetime payment to employers of £1,000 for every employee who they previously claimed under the Coronavirus Job Retention Scheme, remains employed through to 31 January 2021, and earns at least £520 a month. Employers will be able to claim the Bonus after they have filed PAYE for January. For more information and to check if you are eligible to claim the bonus, see here.

For further details on the Job Retention Scheme from June to October, please see here.

How do I claim?

The online claim service was launched on GOV.UK on Monday 20 April 2020. Any entity with a UK payroll can apply, including businesses, charities, recruitment agencies and public authorities. Employers have the opportunity to also delete a claim, as long as it is within 72 hours of submitting it.

After claiming, companies should allow 6 working days for the pay to come through. This means employers should submit an application by 22 April, to receive payment by 30 April. Businesses are also advised to keep a note or print-out of their claim reference number as confirmation won’t be received via SMS or email.

In preparation to claim, you will need:

- A Government Gateway (GG) ID and password – if you don’t already have a GG account, you can apply for one online, or by going to GOV.UK and searching for 'HMRC services: sign in or register'

- Your ePAYE reference number. You must be enrolled for PAYE online – if you aren’t registered yet, you can do so now, or by going to GOV.UK and searching for 'PAYE Online for employers'

- The number of employees being furloughed. If you have fewer than 100 furloughed staff – you will need to input information directly into the system for each employee. If you have 100 or more furloughed staff – you will need to upload a file with information for each employee; HMRC will accept the following file types: .xls .xlsx .csv .ods.

- Information for each furloughed employee you will be claiming for: Name, National Insurance number, Claim period (per the minimum length of furloughing of 3 weeks) and claim amount, and PAYE/employee number.

- Your bank account number and sort code

- Your contact name

- Your phone number

- Employers will be able to make their first claim under the new scheme from 1 July

- From July, employers will be required to submit data on the usual hours an employee would be expected to work in a claim period and actual hours worked.

- From 1 July, claim periods will no longer be able to overlap months, employers who previously submitted claims with periods that overlapped calendar months will no longer be able to do this going forward.

To be eligible for the grant, employers must confirm in writing to their employee that they have been furloughed. Visit the government’s step-by-step guide for employers and HMRC's webinar for further information and apply online here.

You should retain all records and calculations in respect of your claims. Business owners should ensure that they evidence their financial situation, planning and decision-making from February onwards and they should not make any redundancies in order to be eligible for the scheme.

Employees who believe they are not getting their 80% share can also report any concerns to the HMRC fraud site. HMRC will take action against those abusing the scheme.

In the event that you’ve overclaimed through the scheme, you can:

- correct it in your next claim

- make a payment to HMRC (only if you’re not making another claim)

The government has released further information on what you need to do if you've claimed too much or not enough from the Coronavirus Job Retention Scheme, here.

If you've received a grant, but were not eligible or you've been overpaid, find out what penalties you may have to pay if you do not tell HMRC.

The Growth Company, in partnership with the Greater Manchester Combined Authority and delivery Partners have launched EmployGM, a new service to tackle job market challenges in Greater Manchester as a result of coronavirus (COVID-19). The initiative will enable self-employed individuals who have registered a significant drop in work, secure alternative work opportunities in sectors exhibiting increased worker demand, as well as learning or training opportunities for furloughed staff. More information on the service can be seen here.

Timeline of updates

- On Wednesday 03 March 2021, Rishi Sunak, Chancellor of the Exchequer, announced the extension of the Coronavirus Job Retention Scheme which will ensure that businesses can continue paying employees.

- On 03 March, the Chancellor made announcements extending the scheme until the end of September. Workers will continue to receive 80% of their salary, up to £2,500.

- On May 29, the Chancellor Rishi Sunak, announced how the scheme will become flexible as of July, and will wind down from August to October, with employers contributing national insurance and employer pension, as well as starting to pay towards staff wages.

- On July 8, during his summer statement speech, the Chancellor, Rishi Sunak announced the introduction of a Job Retention Bonus which will allow UK employers to receive a one-off payment of £1,000 for each furloughed employee who is brought back into work and still employed as of 31 January 2021. You will be able to claim it between 15 February 2021 and 31 March 2021. To see if you are eligible to claim the bonus, see the published government guidance.

- On October 31, the Prime Minister extended the Job Retention Scheme which will now run until December.

- On November 5, the Chancellor further extended the scheme to 31 March 2021 and announced that the Job Retention Bonus will not be paid in February and the government will be redeploying a retention incentive at the appropriate time.

- On December 17, the Chancellor extended the scheme until the end of April 2021 and confirmed that the government will continue to contribute 80% towards wages.

- On 3 March, The government extended the scheme to September 2021.

More information is available on the UK Government’s Coronavirus Business Support website.

For more personalised advice call us on: 0161 237 4128 or email us at: BGH@growthco.uk

The information provided is meant as a general guide only rather than advice or assurance. GC Business Growth Hub does not guarantee the accuracy or completeness of this information and professional guidance should be sought on all aspects of business planning and responses to the coronavirus. Use of this guide and toolkit are entirely at the risk of the user. Any hyperlinks from this document are to external resources not connected to the GC Business Growth Hub and The Growth Company is not responsible for the content within any hyperlinked site.